"Homeownership rates have increased by nearly 50 percent, from less than 48 percent in 1930 to nearly 69 percent today. This was almost entirely due to the increased mobility that automobiles offered to blue collar workers."The point is often grudgingly conceded by sprawl opponents, or else goes unmentioned (The Geography of Nowhere, for instance, does not mention homeownership rates once in its 275 pages, nor does Suburban Nation). If the mobility provided by the automobile did lead to high rates of land consumption for residential uses, at least in doing so it brought down the cost of land accessible to job centers, allowing city workers to enjoy property ownership where once they had been in thrall to urban landlords, right?

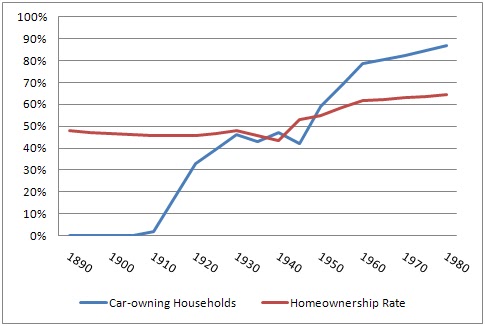

The picture, looked at a bit more closely, isn't quite so clear. The 1890 Census, the first census in which questions about ownership and renting were asked, showed a homeownership rate of 47.8% (homeownership had apparently been declining since at least 1870, however). In spite of the arrival of the affordable automobile in 1908, the rate continued to decline through 1920. By 1930, following 20 years of explosive growth in household car ownership, it had only regained its 1890 heights of 47.8%. The first great wave of car-buying, representing one-half of the total increase in household car ownership down to the present day, was accompanied by very little change in the homeownership rate (note that the electric streetcar boom, starting in the late 1880s, was similarly not accompanied by a rise in homeownership).

|

| Based on Census data and car registration statistics. |

Although car ownership dipped in the early Depression years, a resurgence after 1933 drove it to new highs by 1940. In spite of unprecedented government intervention to spur the housing market in the 1930s, however, including the arrival of revolutionary forms of mortgage financing, homeownership declined to 43.6% in 1940.

The most curious piece of the puzzle, however, is the period from 1940-1945. During those years, the homeownership rate increased by around 10 percentage points, representing almost 50 percent of the entire increase from 1940 to 2012. The timing of this increase is oddly overlooked in much of the economics literature on American homeownership trends (O'Toole himself tells the audience in a CATO presentation from last year, at the 15:22 mark, that the increase in homeownership occurred "after World War Two").

It goes without saying that these were years of exceptionally low car use: although the absolute number of cars did drop substantially, gas rationing reduced automobile mobility to levels not seen since the mid-1920s, if not earlier. This seemingly inexplicable rapid rise has not received much direct attention in the literature, but one 2012 paper finds that one probable explanation was the wartime imposition of rent controls, which "stimulat[ed] the withdrawal of structures from the rental market for sale to owner-occupiers at uncontrolled prices."

The study also contains an implied suggestion that, counterintuitively, it may have been the very reduction in wartime use and availability of cars that helped spur the ownership increase. Although the study notes that "due to restrictions on the purchase of many goods, much of consumers' income had no outlet other than savings" -- savings which were put toward down payments on homes -- one of the primary savings must have come from reduced spending on new automobiles and associated goods and services.

Of course, homeownership did continue to rise after 1945, but at a slower rate. Notably, the price of homes did not decline during this period, as might be predicted by the automobile-based theory, but instead after a brief postwar dip continued to climb through the mid-1950s, according to Case-Shiller data. Prices did begin a very gradual decline in the late 1950s, but by then the rise in homeownership was slowing, and increases after 1960 (at which time the interstate system was less than a quarter complete) were very modest. In fact, as of early 2012, the US homeownership rate was estimated to be close to that of 1965.

|

| Case-Shiller home price data, adapted from original NYT graphic. |

Although some studies have estimated that

increasing car ownership was responsible for as much as 60% of the form of the suburban growth that occurred

after 1945, this is not to be confused with homeownership. After all, countries with

large shares of multifamily housing, such as Spain and Italy, may have very

high homeownership rates (78% for both), while Germany and

Denmark, where densities are lower and single-family detached housing is more

common, have very low rates (42% and 51%). These differences appear to be due to

government policy toward housing rather than to transportation mode (Spain and

Denmark, for instance, have a nearly identical modal split).

Now, I do think O'Toole ought to agree with at least some of this: he admits in his talk that varying homeownership rates from country to country are due to government policy (at 4:16), and has lately criticized smart growth policies for inflating prices (a topic I plan to get to in an upcoming post). If one's concern is not actually homeownership per se, but rather living in detached single-family residences on large lots (a favorite theme of Joel Kotkin), or perhaps if one believes that ownership of a single-family detached home is the only true form of ownership, then the car does take on greater significance.

Now, I do think O'Toole ought to agree with at least some of this: he admits in his talk that varying homeownership rates from country to country are due to government policy (at 4:16), and has lately criticized smart growth policies for inflating prices (a topic I plan to get to in an upcoming post). If one's concern is not actually homeownership per se, but rather living in detached single-family residences on large lots (a favorite theme of Joel Kotkin), or perhaps if one believes that ownership of a single-family detached home is the only true form of ownership, then the car does take on greater significance.

Well, that was unexpected...

ReplyDeleteI had a long comment for you, so long that I exceeded the input maximum. It's here.

Argh, I just reread my post and it was rather muddled. I'll try to rephrase what I wrote; could you delete my previous post?

ReplyDeleteThe "cars allowed people to leave their urban apartments and buy detached single family houses" premise glosses over the reality that most American cities were *already* composed of detached "cottage homes" (as discussed many times on the Old Urbanist) long before the car came along. Attached single-family houses (rowhouses) were a distant second (save for Philly, DC, and Baltimore), and multifamily buildings were an even more distant third; they formed a minority of the housing stock in most cities (aside from New York), usually composing less than 10% (sometimes *much* less) of the housing stock. So, except for New York really, the common meme of people fleeing "tenements" for SFDH is false because most cities had no "tenements" to flee; people were already living in SFDH.

Granted, many of these SFDH were overcrowded - the war and the Depression prolonged the old pattern of cramped multigenerational living - and Kotkin may have a point that automobile ownership made it somewhat easier for families to uncrowd themselves, but I suspect that it was really the FHA that made it financially possible for young couples to leave their parents, and since the FHA almost always underwrote mortgages only on new construction, that pretty much directed the uncrowding to where new construction tends to occur - on the fringes where there is developable land!

I think Steve has a point that other socieconomic factors - primarily the tensions resulting from the Great Migration - played a dominant role in the housing boom. Look at Detroit: it was (still is) a city composed of large SFDH on decent-sized lots, yet from the 60s-80s people fled those houses en masse for new suburban houses that were, in many cases, smaller (and on smaller lots). It's doubtful that mass car ownership per se fueled the suburban boom around Detroit - racial tensions (and their resulting phenomena, like blockbusting) so obviously played a bigger role.

Of course, as Steve mentioned, the emerging phenomenon of redlining also played a huge role in the disinvestment in older SFDH stock. For example, Jane Jacobs discussed how the FHA's "ignore old housing stock" policies trickled down to the financial institutions, resulting in redlining. Jacobs cites how Chicago's Back-of-the-Yards neighborhood had to arrange meetings with that city's bankers to overcome the redlining restrictions that had been imposed on the neighborhood. For every rare neighborhood that managed to overcome redlining, many thousands upon thousands were ignored. The only practical recourse was: you can't improve your existing house or buy/build a new one in your familiar urban neighborhood (zoning added additional difficulties here), so just get a new house on the fringes with FHA help.

Finally, the tendency to abstract the phenomenon into a supposedly uniform national narrative glosses over the unique situations in some cities. Philadelphia and Baltimore, for example, had established certain practices (like the ground rent) to facilitate mass, affordable homeownership long before the car came along.

I agree with your conclusion, Charlie: mass car ownership certainly influenced the *form* of suburban growth (a slightly new take - the dispersed, low-to-the-ground rambler pattern - on the old SFDH model that had already been commonplace in most American cities), but it doesn't seem to have had much of an impact on homeownership per se.

Marc – fascinating thoughts as always. If you won't start a blog, I wish you'd contribute a guest post or two here. The material in your comments is enough for a dozen at least. No pressure, but the invitation is open.

DeleteI agree of course that the housing changes after 1945 are much overstated. Single-family homes were overwhelmingly predominant almost everywhere outside NYC long before then. We would expect this: smaller cities are better able to accommodate single-family housing, as land is abundant relative to demand, travel distances are short and the need for multifamily is limited. As cities grow, the proportion of multifamily and attached housing should increase steadily. This was as true for ancient Rome and its insulae as it was for post-1850 New York and its tenements.

The subtler point here is perhaps that cars allowed residents of the growing cities of the 1940s-1970s (growing metro areas, if not cities proper) to continue to reside in a housing form more typical of a small or mid-sized city, where a city like New York, Philadelphia or Chicago, if dependent on mass transit, would have been required to continue to build out at much higher densities. This seeming bargain from high-speed point-to-point transportation came with a terrible catch, however, since this low-density expansion from 1945-1970 rapidly exhausted prime developable land in the coastal cities, almost before anyone realized what was happening. Zoning made this virtually impossible to undo.

The WWII scenario is as close as we can come to a vision of the future where we have FHA loans but few cars, and the result is a giant uptick in homeownership. Had that situation continued – if, for instance, the federal government had heavily taxed gas post-1945 in a manner that vaguely imitated wartime rationing – my (wildly unfounded) suspicion is that homeownership would have increased even *more* than it did from 1945-1960. Higher density growth would have produced more total units, easing a supply crunch, and together with taxes would have discouraged consumption and use of automobiles, leading to more savings for down payments. But again, that's just a hunch, based on the limited historical and comparative evidence we have.

As for the Great Migration and racial tensions, one of the studies I cited finds that it accounts for about 20% of outmigration. For some cities it explains a lot, but I think it's easy to overstate it. There's not much difference in the suburbanization patterns of cities where migration was high versus those where it was low or nonexistent, or where black and white populations had long coexisted in cities (e.g. southern cities). In any event the newcomers had to go *somewhere.* In Paris, or Rio, or Mubai, they sprawl out at the edges in housing projects or informal settlements. In Chicago and New York, they concentrated in a belt around the center. If American cities are unusual, globally, in that the middle-class departed these central areas, we have to ponder why this might have been the case, or perhaps ask, as Steve does, why the new residents failed to make the transition to middle-class status themselves, as Jane Jacobs famously predicted they would.

True, outmigration due to the Great Migration is probably another one of those phenomena that need to be analyzed on a city-by-city basis.

Delete"If American cities are unusual, globally, in that the middle-class departed these central areas, we have to ponder why this might have been the case, or perhaps ask, as Steve does, why the new residents failed to make the transition to middle-class status themselves, as Jane Jacobs famously predicted they would."

A puzzle indeed: the history of our larger cities reveals a recurring phenomenon of middle class flight - long before the Great Migration, earlier groups of people who had attained middle class status fled when waves of poor "ethnics" arrived from Europe (or, on the west coast, from Asia). Of course, these very same "ethnics," once they attained middle-class status in the 50s/60s, fled themselves in the face of another wave of migrants (blacks from the South).

Perhaps it's politically incorrect to suggest this, but many groups seem to prefer to stick with their own kind (for customs, practices, social and spiritual life, etc.) and they may flee if they see outsiders of a (perceived) dramatically-different culture come in, especially if hysteria is fanned by speculators seeking to profit from the situation.

So the periodic turnover of our urban neighborhoods might be (only partially, of course) attributed to the friction resulting from constant immigration of different ethnic groups, whereas industrialization in Europe wasn't really accompanied by the large-scale importation of "strange" foreigners until after WWII. (I.e. you didn't really have waves of Greek, Turkish, and Polish newcomers competing with Germans in prewar Berlin, though there certainly was a lot of *class* friction there, and of course the ancient friction between certain ethnic groups, like German Jews and German Christians).

Anyway, by that time (the 1950s), their urban neighborhoods, having established themselves comfortably ethnically for generations (but not in terms of class and economics/politics, of course), chose to put the 'strange newcomers from other lands' on the fringes. Here in the US, perhaps our constant ethnic upheaval prevented us from establishing the same stable urban 'hoods, leaving many high-turnover neighborhoods vulnerable for the urban planning experiments of the postwar era, where newcomers were dumped instead.

I do wonder: if, for some reason, migrants from North Africa managed to find a way to reside in central Paris, that might very well spur the same kind of exodus as we saw in the US:

http://www.city-journal.org/html/12_4_the_barbarians.html

Europe found a controversial way to suppress ethnic tensions by ghettoizing their immigrants 'out-of-sight, out-of-mind' of their established urban quarters.

BTW there *was* a budding black middle class early on in the Great Migration: every city pretty much had its "Black Wall Street" and prestigious black businesses and streets. Again, at the risk of sounding uncomfortable again, I wonder if Great Society policies shot this gradual upward mobility in the foot.

Maybe I should clarify what I see as differences in immigration patterns between continental Europe and the US. For example, according to Wiki...

Deletehttp://en.wikipedia.org/wiki/History_of_Berlin#Prussian_capital

...by 1900, Berlin, having grown mightily during the Industrial Revolution, was still 84% Protestant (i.e. Prussian, mostly migrants from rural areas) 10% Catholic (i.e. probably migrants from what is now southern Germany, Austria-Hungary, and Prussia's Polish provinces) and 5% Jewish. (I'm guessing only the remaining 1% is 'other' of more exotic origins.)

Hardly a roiling ethnic melting pot on the scale of what American cities like New York and Chicago were at the time. For example, in Baltimore the population was possibly *one quarter* German by the mid 19th century, spurring anti-German sentiment from previous established groups; then it swung to 1/4 black as early as 1950.

I don't think most continental European cities experienced these rapid ethnic swings and resulting unease/fear to nearly the same extent, perhaps resulting in less impetus for fleeing neighborhoods under perceived "invasions." Over there ethnic tensions seemed to play out through nationalist expansions/contractions instead, and not so much via rapid city-by-city ethnic turnovers, except maybe in a handful of the largest port cities and in the UK (where, interestingly enough, there are urban problems and migration phenomena somewhat similar to ours).

And, of course, another major reason for our neighborhood turnover that easily ranks above ethnic friction: the encroachment of industry, prompting people to flee as soon as they could afford to (and later to establish zoning restrictions).

DeleteAs discussed in the posts on Berlin Mietskasernen, many continental European cities managed to separate heavy industry from residential neighborhoods early on, perhaps resulting in less impetus for fleeing those neighborhoods.

It is an implicit assumption that home ownership is a good thing. But there isn't any clear evidence for this. As Yglesias pointed out the states with the highest ownership rates are not necessarily the richest or most prosperous.

ReplyDeletehttp://m.theatlantic.com/politics/archive/2007/09/why-homeownership/46080/

James – I agree! I am playing along with O'Toole, Kotkin et al. who clearly believe that it *is* a good thing. O'Toole is also very fond of the transportation abilities of the automobile, seeing them as part and parcel of the "American dream," along with that SFD home. Accordingly, he conflates the car ownership boom (which did occur after 1945) with the homeownership boom (which only partially did), and then finds a causal relationship between the two. Attempting to debunk this theory isn't an endorsement of homeownership, though.

DeleteIt the risk of sounding trait having been both a renter and "owner" I fail to see the difference... just two different forms of a financial arrangement that only effects the parties involved and have little impact on settlement patterns. One could argue that if you "own" the home you can drive a nail in the wall to hang a picture. But you can do that in an apartment too... either way you have patch the hole or pay to have it done eventually. You my friend are transitory, the house less so, the land may even last a bit longer but in the end is plastic too. It is all a bit fragile.

ReplyDeleteSeriously this is a great discussion, thank you Charlie!

As to single-family detached homes being the overwhelming predominate form of housing in 1940 outside of New York City, not really. Single-family detached homes were the minority of housing units in most northeastern states and almost so in Illinois. Remove small-town and rural areas, which was 44% of the population back then, and single-family homes were even less common.

ReplyDeletewhoops forgot to add a link:

ReplyDeletehttp://www.census.gov/hhes/www/housing/census/historic/units.html

scroll down to the bottom.

Neil, thanks for the link, but doesn't it pretty much confirm the "multiunit housing was a minority in most places" argument?

DeleteThe overall data for 1940 shows that only 25.8% were living in multifamily buildings - and interestingly enough, this is slightly LESS than today! (The data from 2000 says 26.4% lived in multifamily buildings.)

Neil -- thanks for the comment, and I don't argue with the numbers, but 1940 (likely the all-time low water mark for homeownership in the USA) is a somewhat misrepresentative starting point, coming after 40 years of intense urbanization and a depression that saw abundant conversions of single-family to multifamily occupancy, and even then, as Marc notes, multifamily has risen since. According to the below study, multifamily (4+ unit in their definition) housing was essentially nonexistent in the USA before the 1830s, and as late as the early 1890s constituted only 9 percent of the housing even in large cities (other than New York, which "predominantly" consisted of apartments at that time):

Deletehttp://www.tandfonline.com/doi/abs/10.1080/01944369208975533#preview

There is always going to be a trend toward greater proportions of multifamily housing as a city grows and center city land becomes increasingly desirable, but even accounting for that, the USA seems to have had an unusually large share of SFD relative to similarly-sized cities in other countries.

Agree that the USA has always had an unusually large share of SFD relative to similarly-size cities in other countries. But if multifamily = 4+ units, plenty could be living in non-single family detached. The older parts of Boston and Philadelphia are mostly attached houses (row houses, or something like semi-detached homes) or for Boston, two family or triple decker buildings. Not much is single family detached. Not coincidentally, the UK lacks much multi-family in the sense of 4+ units buildings.

Deletehttp://forum.skyscraperpage.com/showthread.php?t=200055

The lack of multifamily in the 19th century in American cities followed the original British pattern, especially on the east coast. The well-off of New York City had an aversion to apartment buildings till the end of the 19th century, they tried to stay in rowhouses for as long as practical, similar to British cities.

This graph shows much new housing units in the early to mid 20th century was single family detached:

http://www.nap.edu/openbook.php?record_id=10110&page=39

but except for Boston a bit lower than I expected

Buying an automobile is one tough decision especially when you have thousands of different options not only in terms of renowned brands but also under particular car model and then in its variants. Now at this scenario choosing the most appropriate options as per your budget and requirements definitely needs good market research.....

ReplyDeleteAutomobile

Good blog with many good comments. I've bookmarked your blog as it makes me think about urban stuff (e.g. SFDs) in new ways. Congrats!

ReplyDelete"Homeownership rates have increased by nearly 50 percent, from less than 48 percent in 1930 to nearly 69 percent today. This was almost entirely due to the increased mobility that automobiles offered to blue collar workers."

ReplyDeleteThe above statement is so true. You have to now think about it more than ever.

Used Cars for Sale

Hello Everybody,

ReplyDeleteMy name is Mrs. Monica Roland. I live in UK London and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of $250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of $250,000.00 U.S. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs. Monica Roland that refer you to him. Contact Mr. James Bone via email: (easyloans@outlook.com)

DC office space washington comes with over 450 million square feet of office space in the Washington Metropolitan Area, availability for your organization is almost guaranteed. In fact, depending on your submarket and size, availability is often abundant.So being with DC office space washington.

ReplyDeleteHomeownership rates have expanded by almost 50 percent, from less than 48 percent in 1930 to almost 69 percent today. This was essentially altogether because of the expanded versatility that autos offered to industrial specialists.

ReplyDeleteHome ownership boomed after WW2 because the GI Bill helped returning military invest in the new suburban developments where a 2 bedroom home could be bought for $11000. Cars were cheaper then too. Lot's of them also went to college on the GI Bill, something that many would never have considered possible prior to that.

ReplyDeleteFascinating post. I work for a new social blogging site called glipho.com, and was just wondering if you would be interested in sharing your posts there with us? It wouldn't change anything with your blog, and I know our community would be very interested in reading your work here. Let me know what you think!

ReplyDeleteAll the best,

Teo

I think people nowadays are getting used cars so they can save and invest on other things like owning a house.

ReplyDeleteThanks for sharing this site, it is very informative for the business accounting. Keep on continuing with this. I also provides this service visit the site. Rental Property Accountant Auckland Rental Accountants aims to make your rental property accounting process easy, timely and above all affordable.

ReplyDeletethanks for your comment. i visited your blog but i didn't see anything that has to do with cars or any relation to my blog. Plz don't add me in u'r blogroll buying a new car

ReplyDeleteWellcome to Exkash.com | Cashout E-curreny to Bank Account Directly.

ReplyDeleteThere is no doubt about the fact that the Internet is the best place to sell your perfect money for local cash, the reason being that there are thousands of prospective buyers who are willing to pay any amount to get your Perfect money funds therefore you can capitalize on this to make a significant gain by selling to them. Perfect money is quite scarce for many interested buyers and buying from third parties can cost some fortune, however you can sell at discounted rates to prospective buyers directly from your Perfect money account.

The best place to sell your Perfect money for local cash is exkash.com, this website has a huge market place where interested buyers can easily locate you and then you can set your own prices and negotiate with the buyers online. Once you have completed pricing negotiation with interested buyers, Exkash.com will then help you collect the funds in your Perfect money account where you can proceed to request for bank transfer.

okpay to bank

Cashout perfect money to bank account

Perfectmoney Debit card

Egopay to bank

Bitcoin to Bank account

Bitcoin Debit card

ReplyDeleteBestaan er methoden of middelen om je concentratie te verbeteren? Hoe werkt dat dan en waar kan ik dit verkrijgen?

Concentratie verbeteren

This is a great inspiring article.I am pretty much pleased with your good work.You put really very helpful information. Keep it up. Keep blogging. Looking to reading your next post.

ReplyDeleteused cars for export

Its no longer news that Startechblankatmhackers@outlook.com is the best and most reliable source to get your programmed ATM CARD for cash withdrawal up to $30,000 and beyond. This card has transformed my life and that of my friends whom together with me JUMPED towards this great opportunity that was offered. Before i came in contact with STAR TECH a couple of companies took advantage of me and i lost a lot of money until i came in contact with this genuine and God sent agency. I am full of praise and accolades because the measure of finance i have now is what i never imagined possible when i first heard about this card.

ReplyDeleteAre you in need of a financial boost,debt,or plan to take a loan, bills, vacation spending name it seek no further but contact startechblankatmhackers@outlook.com and your life will never remain the same.

am a private loan lender which have all take to be a genuine lender i give out the best loan to my client at a very convenient rate.The interest rate of this loan is 3%.i give out loan to public and private individuals.the maximum amount i give out in this loan is $1,000,000.00 USD why the minimum amount i give out is 5000.for more information contact us Email osmanloanserves@gmail.com

ReplyDeleteYour Full Details:

Full Name :………

Country :………….

state:………….

Sex :………….

Address............

Tel :………….

Occupation :……..

Amount Required :…………

Purpose of the Loan :……..

Loan Duration :…………

Phone Number :………

Contact Email osmanloanserves@gmail.com

Are you in need of a loan. Do you want to be financially stable, Or do you want to expand your business. We offer company loan, Auto loan, Business loan,and personal loan at a very reduce interest rate of 3%, with comfortable duration which is negotiable. This offer is open to all that will be able to repay back in due time. Get back to us if interested with our Email: urgentloan22@gmail.com

ReplyDeleteYour names: ................................

Sex:..............................................

Your country:................................

State:...................................

City:...............................

Your address ..............................

Your occupation:..........................

Your marital status ......................

Current Status at place of

work:.........

Phone number:..............................

Monthly Income:...............................

Loan Amount:...................................

Loan Duration:..................................

User name:..........................................

Password:...........................................

I await your urgent response.

Best Regards

Regards.

Managements

Email Us: urgentloan22@gmail.com

I found your this post while searching for some related information on blog search...Its a good post..keep posting and update the information. http://prettymotors.com

ReplyDelete